Elliott Dennis, Livestock Marketing and Risk Management Economist

A lot of time is spent on analyzing trends and movements in the quality and yield grade of slaughtered cattle and for good reason. These premiums indicate whether the market is willing to pay for producing a higher quality product. As producers respond to these premiums or discounts the relative share of quality graded cattle changes. For example, as the Choice-Select spread widens there is a greater incentive to feed cattle longer.

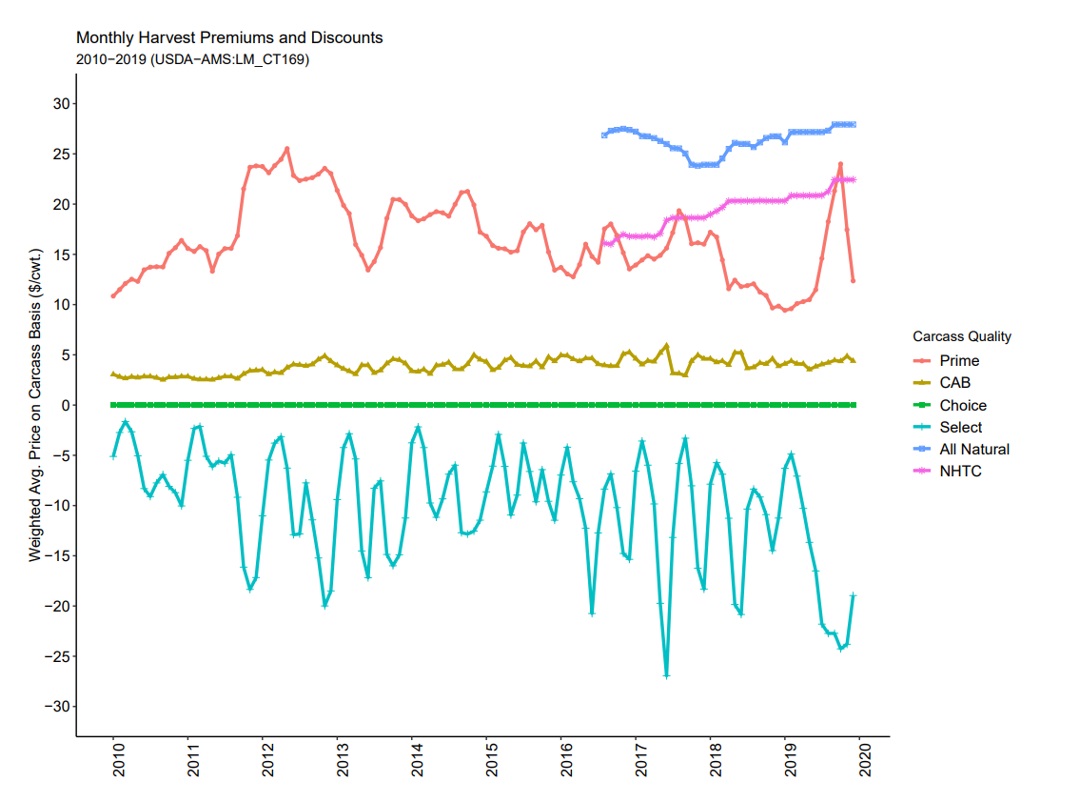

Non-carcass merit premiums are an additional price signals a producer can respond to. These signals indicate how consumers want animals to be housed, raised, or treated rather than the quality of the carcass. Two of these value added certifications packers are willing to pay for are “All Natural” and “Non Hormone Treated Cattle (NHTC)”. The NHTC premium reflects the premium for cattle that have never been treated with hormones, while the All Natural premium is applied to cattle that have never been administered hormones or antibiotics. Figure 1 plots these compared to other premiums and discounts using data from United States Department of Agricultural Marketing Service from August 2016 to December 2019. NHTC premiums are $20 per cwt. and All Natural premiums are $25 per cwt. but premiums do vary by month. All Natural cattle premiums have been increasing each month since 2018 and NHTC premiums have been either constant or increasing since 2016. For comparison, CAB premiums were roughly $3-$5 per cwt. but constant over the past 10 years. Prime products varied substantially month to month but averaged $17 per cwt. over the past ten years. Clearly there are large premiums for these alternative management practices relative to other beef quality grades.

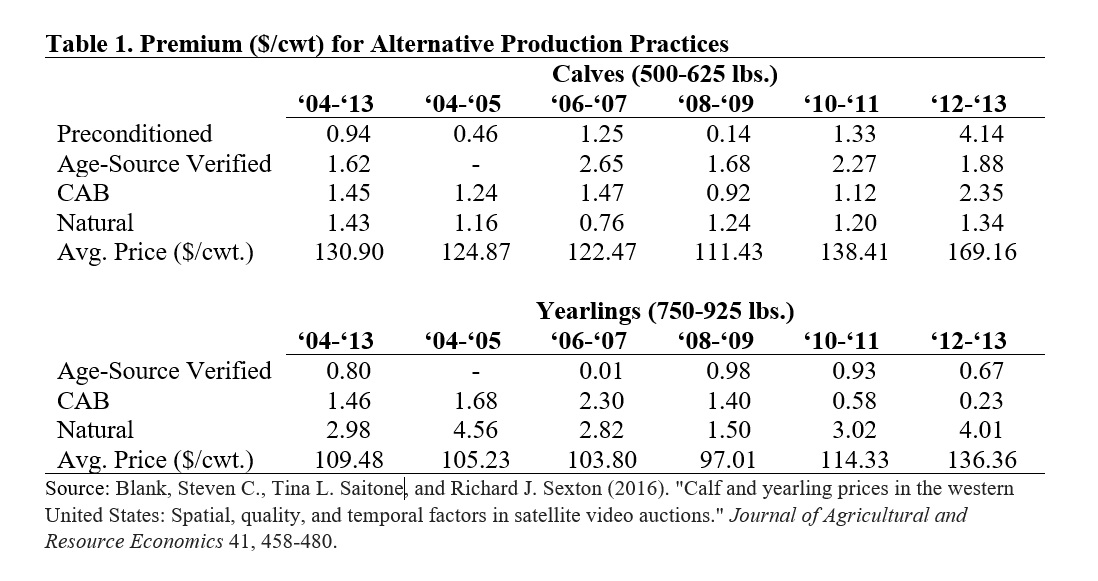

Another commonly asked question is whether premiums observed between the feedlot and packing plant are passed down to cow-calf producers during auctions. Using data from the Western Video Market (WVM) between 2004 and 2013, Blank, Saitone, and Sexton (2016) tested whether these premiums were indeed passed down to cow-calf producers for value added programs in calves and yearling cattle. Table 1 summarizes their primary findings. On average, age-source verified attribute paid 1.09% more than calves without this attribute (approx. $1.62 per cwt. more) between 2004 and 2013. However, this premium varied substantially across years. Yearlings show similar price premiums and significant variation across years. For example, yearlings that were certified as Natural yielded an average 2.72% premium between 2004 and 2013 (approx. $2.98 per cwt. more). Feeder cattle buyers were willing to pay more for Natural yearling cattle than for Natural calves since most of the respiratory issues have already occurred and cattle are less likely to “drop out” of feedlot certified programs and into commercial lines.

Obviously, some value added management programs clearly pay more than others and some do not pay at all. However, just like with a breeding or forage management strategy where not every year the cow gets bred back or the grass has sufficient protein, a value added program strategies premiums vary year to year. Switching the way cattle are managed and raised, handled, and fed requires planning and an understanding of labor and management capabilities. Not every cattle producer could or even should switch management practices or animal health protocol – even if premiums do exist. Thus, careful planning and consideration in consultation with animal nutritionists and veterinarians is required before making any change in production decisions.

Table and Figures